Statement from the Panama Maritime Law Association

19/08/2020

Francisco González-Ruiz receives recognition from Panama’s Bar Association

31/08/2020[vc_row][vc_column][vc_column_text]

Let’s review why Economic Substance requirements were implemented, and how to keep your companies compliant with jurisdictional regulations.

In response to the European Union and the OECD’s efforts to enhance tax transparency, Economic Substance legislation has been introduced in major offshore jurisdictions such as the British Virgin Islands, Bahamas, the Cayman Islands, among others. Once these laws were in force, many aspects of compliance were not clear, nor were there final guidance notes available for agents managing entities to adequately explain the effects of these regulations on their client’s companies. This caused a high level of uncertainty, raising questions whether these companies were appropriate for their structures.

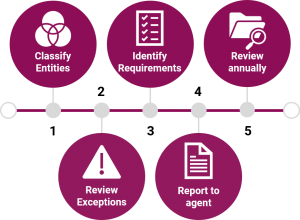

In the following months, final guidance documents were issued, and after analyzing these regulations, a considerable percentage of entities resulted to be out of the scope of these laws, and for those who are, complying with the law is more straightforward than initially thought. Below we describe the necessary steps to take to ensure compliance:

Economic Substance Compliance process

1. Classify the activity of your company: Take into consideration the relevant core income-generating activities that fall within the scope of Economic Substance Laws. For this case, we will use the British Virgin Islands (BVI) jurisdiction as an example:

Relevant activities:

– Banking

– Distribution and Service center

– Financing and leasing

– Fund Management

– Headquarters

– Holding company

– Insurance

– Intellectual Property

– Shipping

Ask yourself the following questions:

- Does my entity perform any of the above-mentioned relevant activities?

- Do I receive income from one of these activities?

If the answer to these questions is yes, your entity is within the scope of the law.

2. Verify if your company is under any of the exceptions to the law:

- Companies that are tax resident in a jurisdiction other than the BVI (that is not in the EU non-cooperative list), and can provide evidence to prove their tax residence, are outside the scope of the law.

- Companies that do not conduct relevant activities, such as property investment business, property holding, property trading, investment funds, among others, are not within the scope of the law.

- Companies that do not generate income during the reporting period are not within the scope of the law.

3. Determine the substance requirements applicable to your company:

A. For holding companies: Pure equity holding entities which carry on no relevant activity other than holding equity participations in other entities and earning dividends and capital gains have reduced economic substance requirements, namely:

- Complying with its statutory obligations under the BVI Business Companies Act, 2004, or the Limited Partnership Act, 2017, meaning the standard yearly requirements for all entities. For example: Maintaining all company records updated, such as the register of directors, beneficial owners’ information, etc.

- Adequate employees and premises for holding equitable interests: The premises and the employees must be maintained locally, and outsourcing these services is allowed. This requirement can be fulfilled by retaining the services of the registered agent which is currently providing registered office services for the company.

B. For other activities: Substance requirements include:

- Physical premises: in the jurisdiction,

- Adequate employees: in the jurisdiction, proportionate to the activity,

- Managed and directed (board) locally: board meetings in the jurisdiction, adequate number of meetings held, the quorum of the board to be physically present in the jurisdiction, drafting minutes of the strategic decisions of the company, and keeping minutes of the meetings in the jurisdiction.

- Core income-generating activities: conducted locally,

- Operating expenditure: must be proportionate to the relevant business activity taking place.

4. Report required information to the registered agent: As details on your BVI entity will need to be added to the Beneficial Ownership Secured Search (BOSS) system, you must provide your agent with the necessary information in a timely manner so your company will remain compliant and to avoid penalties.

5. Conduct a review of the company’s structure annually, and determine what works best for your situation: As economic substance requirements must be complied with on an annual basis, changes in your structure, activities, or business model may affect your company’s status; therefore, it is necessary to conduct a yearly review to build substance and report information accordingly.

For Economic Substance requirements in other jurisdictions, view our Economic Substance – Comparison chart.

What can we do to help?

To assist you in complying with this legislation, we can classify your entity, confirm the applicable substance requirements, and provide outsourced services to build substance. Further, we can assist you in the review of your company’s structure and advise you on the best route forward.

If you have any questions or if you would like to learn more about our services, contact us at bd@icazalaw.com.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]