Seychelles – Virtual Asset Service Providers Act, 2024

02/09/2024

Icaza, González-Ruiz & Alemán ranked by Chambers Latin America 2025

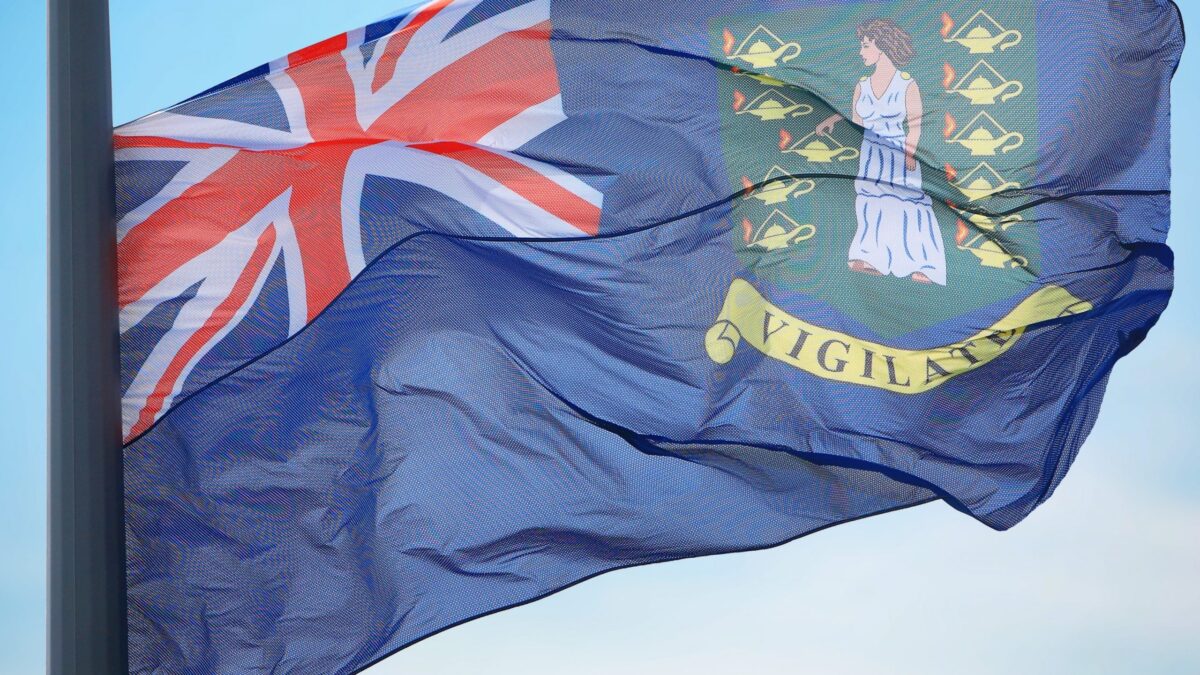

09/09/2024When it comes to managing wealth and ensuring a seamless transition of assets, estate planning is crucial—especially for those holding shares in BVI (British Virgin Islands) companies and offshore assets.

By: Estefanía Alemán

While it might be tempting to hold these assets in your name, doing so can lead to a host of complications that could burden your heirs and put your hard-earned wealth at risk.

This article explores why holding assets in your name is not advisable and presents efficient estate planning alternatives to protect your legacy, simplify legal processes, and safeguard your assets from creditors. Whether you are new to estate planning or looking to refine your strategy, understanding these options will help you make informed decisions that ensure the long-term security and smooth transfer of your wealth.

Having BVI assets under your personal capacity may cause some of the following hurdles:

- Forces your heirs (i.e. your partner and/or children) to go through a Grant of Letters of Administration if you pass away intestate, or a Grant of Probate if you pass away and leave a Will.

- If you become incapacitated, it forces your partner or children to request before a court to be appointed as your tutor or legal representative to manage and administer your assets.

- Allows your creditors to reach your assets.

First, we discuss why going through a Grant of Letters of Administration or Probate is not an efficient estate planning alternative. Second, we discuss recommended estate planning alternatives for shares of BVI companies and offshore assets such as i) Life Tenancy with Rights of Survivorship; ii) Class A and Class B Shares; and iii) Trusts. Finally, we share our opinion about the most efficient estate planning alternative.

I. GRANT OF LETTERS OF ADMINISTRATION OR PROBATE

If you pass away intestate and you have BVI assets (i.e. share of BVI companies), you need to carry out before court a process called Grant of Letters of Administration. If you pass away and leave a Will under BVI or under foreign law, you need to present it before the BVI court a Grant of Probate.

To carry out an application of a Grant of Letters of Administration, or a Grant of Probate concerning a foreign Will, the interested party needs to present an Affidavit of Foreign Law sworn by a lawyer qualified to practice in the jurisdiction where the deceased was domiciled at the time of death. The affidavit needs to confirm who are the heirs of the deceased in accordance with the laws of the jurisdiction, or in accordance to the foreign Will. Additionally, the interested party must provide apostilled copies of the deceased’s and heirs’ passports. If the deceased leaves a BVI Will, a BVI lawyer needs to present this Will before the BVI Probate Registry. Under both processes, the interested party through their BVI lawyer also needs to present an affidavit with the value of the estate.

A Grant of Letters of Administration or a Grant of Probate is a process that might take between 8 to 15 weeks in the BVI. The interested party is responsible for paying fees of the BVI lawyer who will represent him or her in the process, and disbursements which depend on the number of documents filed with the BVI Probate Registry and the value of the estate.

Leaving a Will is more recommendable than passing away intestate because it allows you to determine to whom and in what proportions your assets should be distributed after your death. However, a Will does not allow you to plan your succession in a flexible or conditioned manner. It is a straightforward document in which you may only establish who are your heirs and their proportions. Additionally, it requires your heirs to go to court to execute such Will in accordance with the processes described above.

II. LIFE TENANCY WITH RIGHTS OF SURVIVORSHIP OR CLASS A AND CLASS B SHARES

Life Tenancy with Rights of Survivorship and Class A and Class B Shares are ownership structures that allow for BVI shares to succeed automatically without the need of opening a Grant of Probate or a Grant of Administration before a BVI court.

BVI shares may be owned by life tenants with rights of survivorship. When any of the life tenants passes away, the surviving tenants continue being the sole shareholders of the shares with equal rights among them.

BVI companies may issue Class A shares to a shareholder with economic and voting rights, and Class B shares to shareholders with no rights. The M&AA of these companies may establish that when the Class A shareholder passes away, the company may redeem his or her shares without consideration, and the Class B shareholders acquire the economic and voting rights of the shares.

Both ownership mechanisms allow for the shares to pass to someone’s heirs at the time of death in an automatic and extrajudicial manner. Nonetheless, these mechanisms are straightforward and may not be the best option for someone seeking to accomplish a structured, conditioned or flexible estate planning.

III. TRUSTS

Trusts are estate planning structures that offer flexibility, confidentiality, and the opportunity to tailor your needs to your own measures.

In BVI, there are various types of trusts, each serving different purposes and offering unique benefits:

1. Discretionary Trusts: In a discretionary trust, the trustee has the power to decide how the trust’s income and capital are distributed among the beneficiaries. This type of trust offers flexibility, as the trustee can respond to changes in beneficiaries’ circumstances over time.

2. Fixed Trusts: Unlike discretionary trusts, beneficiaries of a fixed trust have a predetermined entitlement to the trust’s assets. This type of trust provides certainty, as the trustee must follow the terms of the trust document without discretion.

3. VISTA Trusts: The BVI offers a unique type of trust known as a VISTA (Virgin Islands Special Trusts Act) Trust, which are specifically designed for holding shares in BVI companies. They allow the trustee to retain the shares without the obligation to interfere in the management of the company, which is a common requirement in traditional trusts. This makes VISTA Trusts particularly appealing for those who wish to retain control over their business operations while benefiting from the asset protection offered by a trust. The main difference between a VISTA and an Ordinary Trust under BVI Law lies in the level of control retained over the underlying assets. In an ordinary trust, the trustee is typically required to manage the trust assets prudently, which might include selling shares if they believe it to be in the beneficiaries’ best interest. However, in a VISTA Trust, the trustee is not obligated to interfere with the management of the company, allowing the settlor (the person creating the trust) to maintain control over business decisions.

In summary, the Trust is the most flexible estate planning structure. In the long term it will save your family money, time, and energy.

For more information about this matter, contact us at bd@icazalaw.com.